Everything You Need To Know About Investing In Treasury Bills In Nigeria

Everything You Need To Know About Investing In Treasury Bills In Nigeria

Would you like to put money aside and earn significant interest returns in only a few weeks or months? You might consider buying treasury bills, a popular and accessible form of investment.

Treasury bills are one of the safest forms of investment in the world because they are backed by the federal government. They are considered risk-free. They are also used by many other governments throughout the world.

Recommended: How to Calculate Treasury Bills in Nigeria (Full Guide)

1. What is a treasury bill?

Treasury Bills are short-term debt instruments issued by the Federal Government through the Central Bank to provide short-term funding for the government. They are by nature, the most liquid money market securities and are backed by the guarantee of the Federal Government.

They are usually issued for tenors of 91 days, 182 days and 364 days at the primary market auction held fortnightly by the Central Bank of Nigeria. The interest rate (stop rate) at the auction is not fixed but fluctuates based on demand and amount offered by the apex bank. The difference between the value of the bill and the amount you pay for it is called the discount rate and is set as a percentage.

Also Read: Top 5 Best Bitcoin Exchangers In Nigeria 2020 And Why

2. How does treasury bill work?

Basically, the Federal Government issues treasury bills at discounted prices for maturity periods between 91 and 364 days. At the end the selected maturity period, the government buys the bills back at full price. For example, let’s say you buy a 182-day ₦200,000 treasury bill at a discounted rate of ₦180,000.

The Federal Government of Nigeria writes an IOU for ₦200,000 and agrees to pay back in 182 days. You don’t get any monthly interest payments, rather you make your money back when the bond is purchased back from you at full price. In this case the T-Bill pays 11% interest rate (₦20,000/₦180,000 = 11%) over the 182-day period.

3. Treasury Bills Vs. Government Bonds.

When the government is going to the financial market to raise money, it can do it by issuing two types of debt instruments – treasury bills and government bonds. Treasury bills are issued when the government needs money for a shorter period while government bonds are issued when they need debt for more than say five years.

Treasury bills; generally shortened as T-bills have a maximum maturity of 364 days. Hence, they are categorized as money market instruments (money market deals with funds with a maturity of less than one year). People usually use the terms “notes” or “bonds” to refer to longer-term treasury instruments.

4. Benefits of investing in treasury bills.

- It is a risk-free investment as it carries the guarantee of the Federal Government.

- Treasury Bills are very liquid and can be converted to cash quickly.

- A liquidity-active secondary market for ease of entry and exit (though at a cost).

- It is a discount instrument enabling the investor to earn interest upfront, thereby, increasing the effective yield on investment (on the assumption that the interest earned is re-invested).

- Interest earned is tax exempted.

- They can be used as a collateral.

Also Read: Nigeria’s Top Banking And Their Contacts

5. How to buy treasury bills in Nigeria.

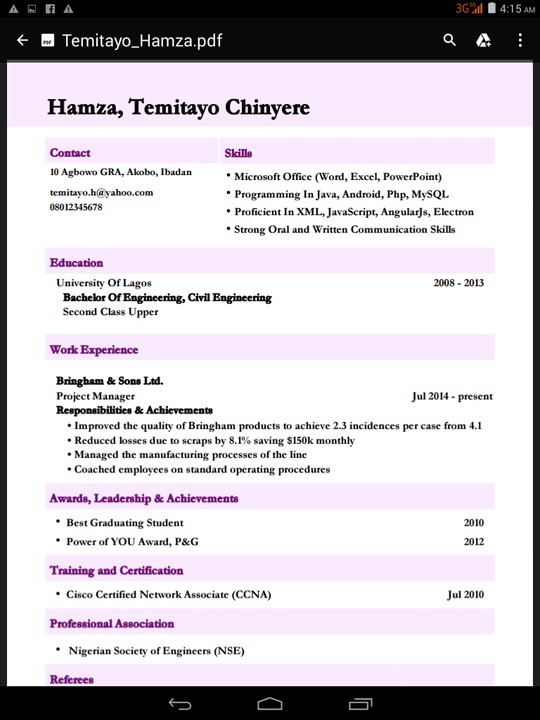

If you are interested in investing in treasury bills here’s how to go about it. Treasury bills are usually held by financial institutions including banks. Treasury bills can be bought through your bank the process is simple. Get in touch with your bank and you will be put through. The minimum amount of treasury bill you can buy depends on the dealer. Some banks offer a minimum of ₦50,000, while some offer a minimum of ₦500,000.

You can invest your T-Bills for 91 days, 182 days or 364 days. This means for example that, if you invest for 91 days, your investment will mature after three months. If you invest for 182 days, your investment will mature after six months and so on.

6. Who can buy treasury bills?

Individuals, Firms, Trusts, Institutions, and banks can purchase T-Bills.

We Believe This Article Was Helpful, Don’t Hesitate To Share This Information With Your Friends On Facebook, Twitter, Whatsapp and Google plus.

Copyright Warning: Contents on this website may not be republished, reproduced, redistributed either in whole or in part without due permission or acknowledgement. All contents are protected by DMCA.

The content on this site is posted with good intentions. If you own this content & believe your copyright was violated or infringed, make sure you contact us via This Means to file a complaint & actions will be taken immediately.