Industrial Gas Supplier – All You Need To Know About Gas Supplier

Industrial Gas Supplier – All You Need To Know About Gas Supplier. It’s simple to discover which energy provider serves your home. How to locate a gas or electricity provider depends on whether you’ve recently moved into a new home or whether you’ve already established a relationship with an existing provider.

Introduction

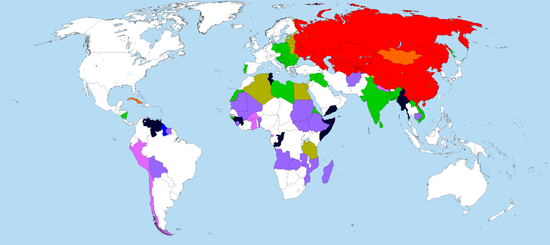

The oil and gas business generates an estimated $3.3 trillion in income each year, making it one of the world’s most profitable industries. In terms of the world economy, oil is essential, particularly for the major oil producers: the United States, Saudi Arabia, Russia and Canada. There is a lot of lingo and numbers used in the oil and gas business that may rapidly overwhelm new investors. The purpose of this introduction is to provide readers with a basic understanding of the oil and gas industry by outlining essential concepts and defining measurement standards.

See also: Top 10 business gas suppliers

The Hydrocarbons

Oil and natural gas are derived from hydrocarbons, which exist naturally in the earth’s crustal rocks. Remains of plants and animals are compressed in sedimentary rocks like limestone, limestone shale to produce these organic raw materials. Deposits in ancient seas and other bodies of water are the sources of sedimentary rock. Decaying plant and animal carcasses were incorporated into the developing rock when it was deposited on the ocean bottom in layers of silt.

When organic material is subjected to appropriate temperatures and pressures deep under the earth’s crust, it ultimately converts into oil and gas. Unlike water, oil and gas may move through permeable sedimentary rock and eventually reach the earth’s surface. An oil and gas reservoir is created when hydrocarbons are trapped behind a less permeable cap rock. In other words, they’re the places where we get our crude oil and natural gas.

Drilling through the cap rock and into the reservoir is the method used to extract hydrocarbons and bring them to the surface. Oil and gas production may begin as the drill bit hits the reservoir, and hydrocarbons can flow to the surface. If economically feasible amounts of hydrocarbons are not found during the drilling process, the well is referred to as a dry hole, which is normally abandoned.

Upstream, Midstream, Downstream

Upstream, midstream, and downstream are the three major divisions of the oil and gas business.

Upstream

Companies engaged in oil and gas exploration and production are considered to be upstream. Drilling is used to collecting raw materials from these companies’ exploration efforts. “E&P” stands for “exploration and production,” and these firms are often referred to as such. Because of the length of time, it takes to identify and drill new wells and the high level of technical sophistication required, the upstream sector carries a high level of risk and requires significant capital expenditure. A company’s cash flow and income statement can’t exist without reference to the company’s oil and gas operations.

Midstream

Transportation-related enterprises fall within the midstream category. They are the ones that transport the crude oil and gas from the fields to refineries. Shipping, trucks, pipelines, and raw material storage are all hallmarks of midstream businesses. High regulation, notably in pipeline transmission, and minimal capital risk characterize the midstream business. The segment’s prosperity is also tied to the success of the upstream companies.

See also: Linde gasses: Location, Details And All You Need To Know About It

Downstream

Refineries are firms located farther down the supply chain. These are the firms that remove impurities and turn the oil and gas into goods for the general public, such as gasoline, jet fuel, heating oil, and asphalt, which are sold to consumers.

Service and Drilling Firms

E&P businesses typically do not own or employ their own drilling rigs or rig crews. Instead, they use the services of contract drilling businesses to carry out the labour of drilling wells, and these companies often charge by the number of hours they work for an E&P company. E&P firms, on the other hand, produce income that is directly linked to the production of oil and gas.

A well’s output is generated and maintained throughout time by a variety of actions once it is drilled. It’s called “well servicing,” and it encompasses everything from logging to cementing to perforating to fracturing to maintaining. As a result, the oil and gas industry’s oil drilling and oil service divisions are separate legal entities.

Many public firms are active in well servicing, much like drilling. As activity levels in the oil and gas sector increase, so does income for service firms. Counting the number of rigs and their rates of use might give you an idea of how busy the United States is at any one moment.

Conclusion

If you ask any question or opinion concerning this post, kindly use the comment section below and we would reply to your message as soon as possible.

We Believe This Article Was Helpful, Don’t Hesitate To Share This Information With Your Friends On Facebook, Twitter, Whatsapp and Google plus.

Copyright Warning: Contents on this website may not be republished, reproduced, redistributed either in whole or in part without due permission or acknowledgement. All contents are protected by DMCA.

The content on this site is posted with good intentions. If you own this content & believe your copyright was violated or infringed, make sure you contact us via This Means to file a complaint & actions will be taken immediately.